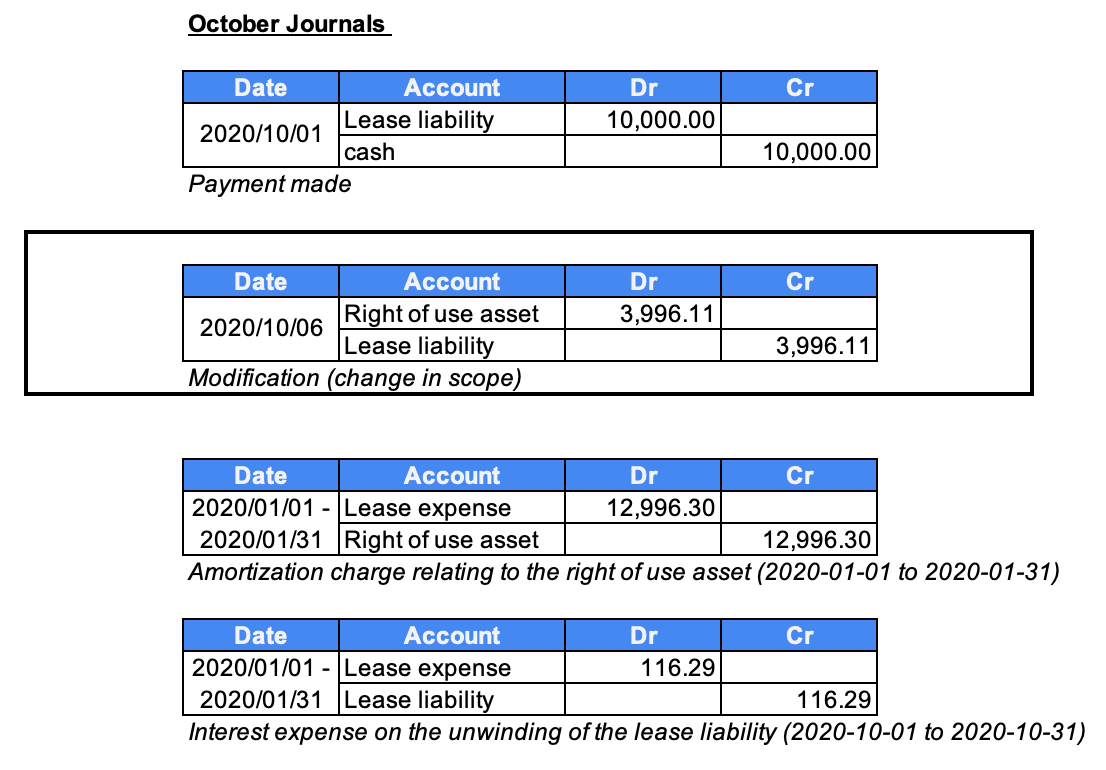

Paying cash is a decrease to the asset (credit). Paying later is an increase to a liability (credit). Total debits must always equal total debits. B. Cost of goods sold is the account that is used to show that inventory is used to provide goods to the customer.

Account Balances and Calculations

D. A journal entry must always have equal debits and credits. The answer must contain a debit and a credit. The asset land increases with a debit.

Which journal entry will VC Consulting make for Victor Cruz’s contribution of $78,000 in cash and $146,000 in land?

Determine the balance for each account.C. Record journal entries for these transactions. Record journal entries for following transactions.

Financial Ratios and Equity

Dividends paid are not a revenue or an expense and are never recorded on the income statement. D. Being provided a service is an increase in an expense. To keep the journal entry in balance you must also use a credit. The expense is either paid for now or is owed for. Paid for now is a credit to cash, an asset, and owed for is a credit to a liability. A journal entry can not have only two credits.

- Test your knowledge of double entry bookkeeping with our accounting journal and ledger quiz.

- (b.) will not occur because cash does not decrease when the customer owes for goods/services.

- D. Issuing stock to investors increases cash, recorded with a debit, and increases common stock, recorded with a credit.

Cash is increased (debit) and accounts receivable is decreased (credit); both are assets. This is the journal entry for when a business makes income but does not receive the payment for this straight away. Accounts receivable is recorded (this is also known as receivables or debtors). This is an asset account representing the amount of funds owed to us.

Decreases are a credit (right/bottom) The beginning and ending balance of an asset will always be a debit. B. Cash and the liability both decrease. The liability is decreased with a debit and cash is decreased with a credit.

B. Accumulated depreciation is always recorded as a credit when depreciation expense is incurred (debit). Depreciation expense is recorded when a long term asset is used. Depreciation expense is not paid since the cash was paid when the long-term asset was purchased. Supplies is a current asset and does not depreciate, they are used. These quizzes are a great way to practice accounting.

Answering these questions efficiently will prepare you for your tests and quizzes. Click the orange text below the quiz to view the answers. Watch the video below each practice quiz to see further explanation on how to solve these accounting practice questions. Supplies that are on hand (unused) at the balance sheet date are reported in the current asset account Supplies or Supplies on Hand. A. Increases to revenue are done with a credit to the revenue account.

Each journal entry must have at least one debit and one credit. A. Amounts owed from what is considered a qualified education expense and what can i claim the customer is accounts receivable. The customer pays cash to the company.

Accounts receivable decreases when the customer pays the company. (a.) & (c.) are recorded with a debit to accounts receivable. D. When writing a journal entry you write the debit on top and the credit on bottom. Total debits must equal total credits, which will keep the accounting equation in balance. Prepare “T accounts” for eachbalance sheet account and prepare a balance sheet.