Think of it like your school bag, where you have different sections or pockets for your books, pencils, and lunch. This method helps people see what the company has (like money, buildings, and patents) and what it owes (like loans or long-term debt) in a clear way. The Classified Balance Sheet is an essential financial tool that enhances the clarity of financial reporting by grouping assets, liabilities, and equity into meaningful categories.

Organizing Assets by Current and Non-Current Categories

Longer-term debt obligations have a full repayment period of more than a year. Companies prefer to take on high levels of long-term debt for reasons including longer payback period, lower cost of debt and potential to raise larger amounts of capital. The internal capital structure policy/decisions of a company will determine how much of long-term debt is raised by a company. The one major downside of high debt levels in the accompanying higher levels of financial leverage which could severely amplify a company’s losses during an economic downturn. By following these steps, a business can prepare a classified balance sheet that provides a clear and organized snapshot of its financial position at a particular point in time.

- However, a classified balance sheet is detail-oriented, polished, and audited.

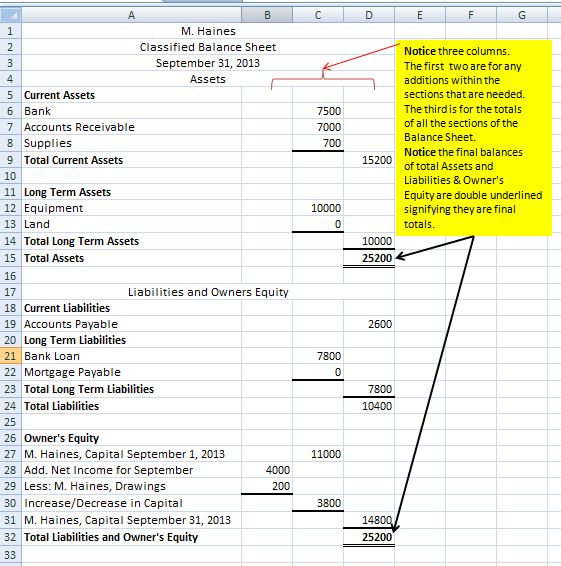

- It starts with assets and provides a total value of assets at the end of the section, followed by liabilities, equities, with the final section totalling up the combined value of liabilities and equity.

- Other titles of balance sheet include statement of financial position and statement of financial condition.

- This part of our article will show you how to put things in the right boxes on a balance sheet.

Examples

A classified balance sheet format gives a fresh and perfectly clear view to the user. Despite the fact that balance sheets are made by accountants, they are also used by ordinary investors who probably won’t have an accounting foundation. The distinctive subcategories assist an investor with understanding the significance of a specific entry in the Classified balance sheet and the reason it has been put there. It additionally helps investors in their financial analysis and settling on appropriate choices for their ventures. These are the assets that are supposed to be consumed or sold to utilized cash within the operating cycle of the business or with the current fiscal year. They are mainly required to fund the daily operations or the firm’s core business.

Key Terms to Remember:

In an increasingly interconnected world, the scope of business has transcended national boundaries, making it essential for stakeholders to understand how balance sheets may vary globally. A classified balance sheet is not an isolated artifact; it’s influenced by a web of accounting practices, regulations, and cultural perspectives that differ from one country to another. The ability to quickly convert these assets into cash is crucial for covering operational expenses and other immediate financial obligations. Creating a classified balance sheet is like organizing your room into sections so you can find everything easily. This guide will show you how to sort a company’s assets, liabilities, and shareholders’ equity step by step.

For example, understanding how much profit a company makes after all expenses are paid helps investors decide if the company is successful. It also shows if there’s extra money available, which could be used to grow the business or pay back loans. Creditors (people who lend money) and investors (people who buy parts of companies) can see how easily a company can turn its assets into cash to pay off debts. Many important details about a company cannot be described in money on the balance sheet. Notes are used to describe accounting policies, major business events, pending lawsuits, and other facets of operation. Oftentimes, the notes will be more voluminous than the financial statements themselves.

Common Classifications In Balance Sheet

They can find out if the company has enough to cover its short-term debts, how much it relies on long-term debt, and what it owns that can make money in the future. This information helps them decide if they want to invest in or lend money to the company. Like classified balance sheet template current assets, the current liabilities only have a life span of one accounting period, usually a year. These are short term debt obligations that need to be paid back either by utilizing the current assets or by taking on new current or long-term liabilities.

Therefore, it is recommended that companies should use classified balance sheets to facilitate the users of their financial statements. It is the format of reporting a company’s or business’s assets and liabilities. In a classified balance sheet, the assets, liabilities, and shareholder’s equity is segregated or categorized into sub-classes.

However, in a classified balance sheet format, such a calculation would be straightforward as the management has specifically mentioned its currents assets and liabilities. It will be easy to figure out and calculate even for a retail investor. A classified balance sheet is like having your school locker organized with separate sections for books, sports gear, and lunch. It groups the company’s assets (things it owns) and liabilities (things it owes) into clear categories. This helps us see what the company uses every day, like cash or products to sell, which are called current assets. It also shows us the big things it plans to keep for a long time, like buildings or equipment, known as long-term assets.

Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs. When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility. Get $30 off your tax filing job today and access an affordable, licensed Tax Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle. Knowing the right forms and documents to claim each credit and deduction is daunting. Taxes are incredibly complex, so we may not have been able to answer your question in the article.